Calculating federal income tax per pay period

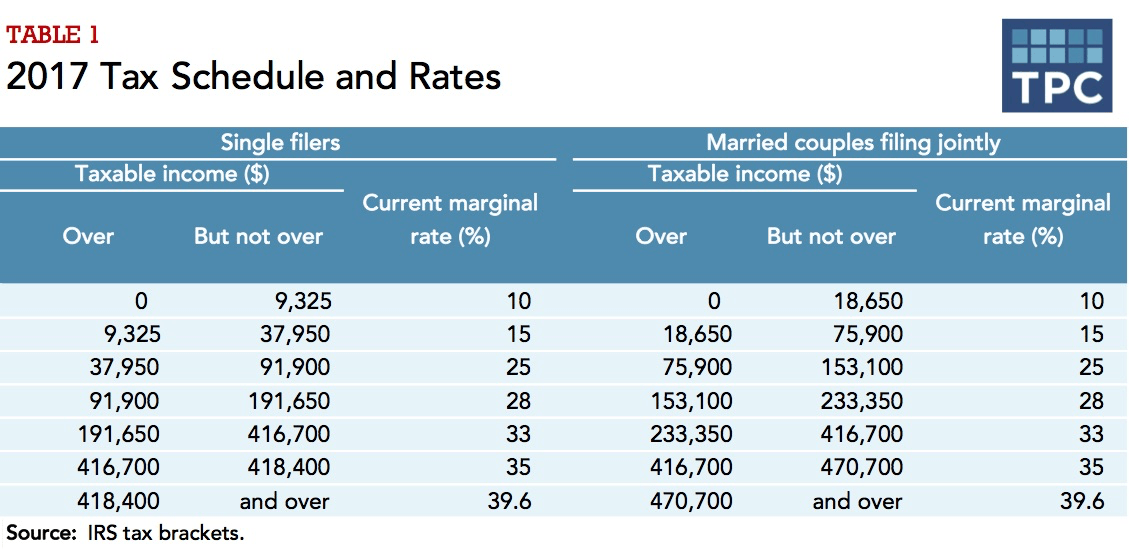

Pay period This is. Your bracket depends on your taxable income and filing status.

How To Calculate Federal Income Tax

Calculate Federal Income Tax FIT Withholding Amount.

. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Use this tool to. 2020 Federal income tax withholding calculation.

The state tax year is also 12 months but it differs from state to state. Your household income location filing status and number of personal. Now that we understand period payments the next step is learning the elements that make up federal income taxable wages from which withholding is calculated.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Then look at your last paychecks tax withholding amount eg.

69400 wages 44475 24925 in wages taxed at 22. These are the rates for. Some states follow the federal tax.

This is 548350 in FIT. Federal Income Tax Deductions. In addition you need to calculate 22 Column D of the earnings that are over 44475 Column E.

Estimate your federal income tax withholding. See What Credits and Deductions Apply to You. You find that this amount of 2025 falls in the.

That result is the tax withholding amount you. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators. 250 minus 200 50.

The amount is the employees gross wages for the pay period. The employees adjusted gross pay for the pay. Ad Enter Your Tax Information.

Subtract 12900 for Married otherwise. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today.

How It Works. Our income tax calculator calculates your federal state and local taxes based on several key inputs. For 2022 employees will pay 62 in Social Security on.

FICA taxes consist of Social Security and Medicare taxes. Federal income taxes are generally based on the marital status and number of allowances you claim on your W-4 form. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

10 12 22 24 32 35 and 37. There are seven federal tax brackets for the 2021 tax year. See how your refund take-home pay or tax due are affected by withholding amount.

To calculate Federal Income Tax withholding you will need. These amounts are paid by both employees and employers. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly. 250 and subtract the refund adjust amount from that.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Federal Income Tax

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Effective Tax Rate Formula And Calculation Example

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Paycheck Taxes Federal State Local Withholding H R Block

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Federal Income Tax

Tax Schedule

How To Calculate Federal Income Tax

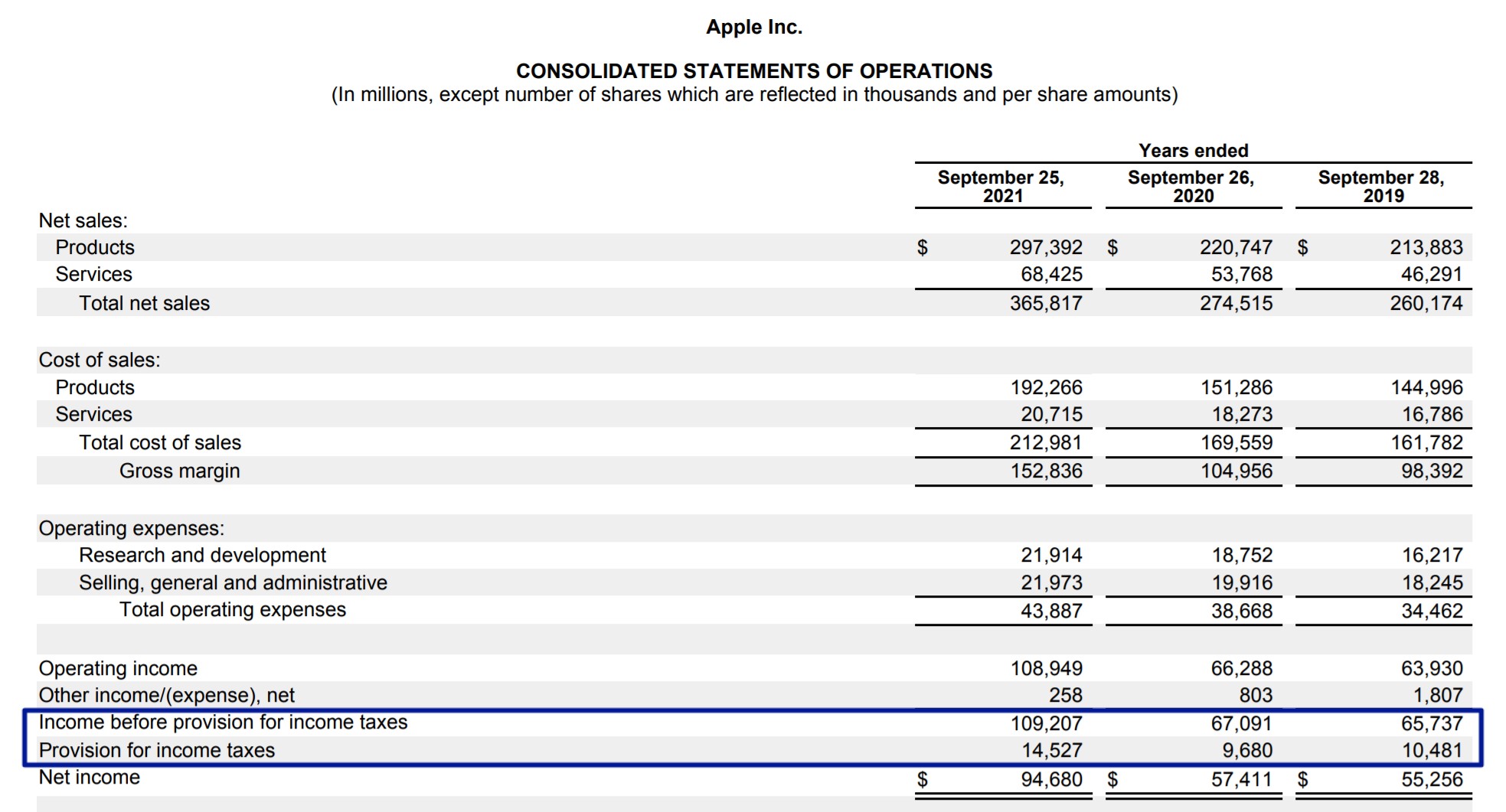

How Federal Income Tax Rates Work Full Report Tax Policy Center

How To Calculate Payroll Taxes Methods Examples More

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Tax Schedule

Payroll Tax What It Is How To Calculate It Bench Accounting

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet